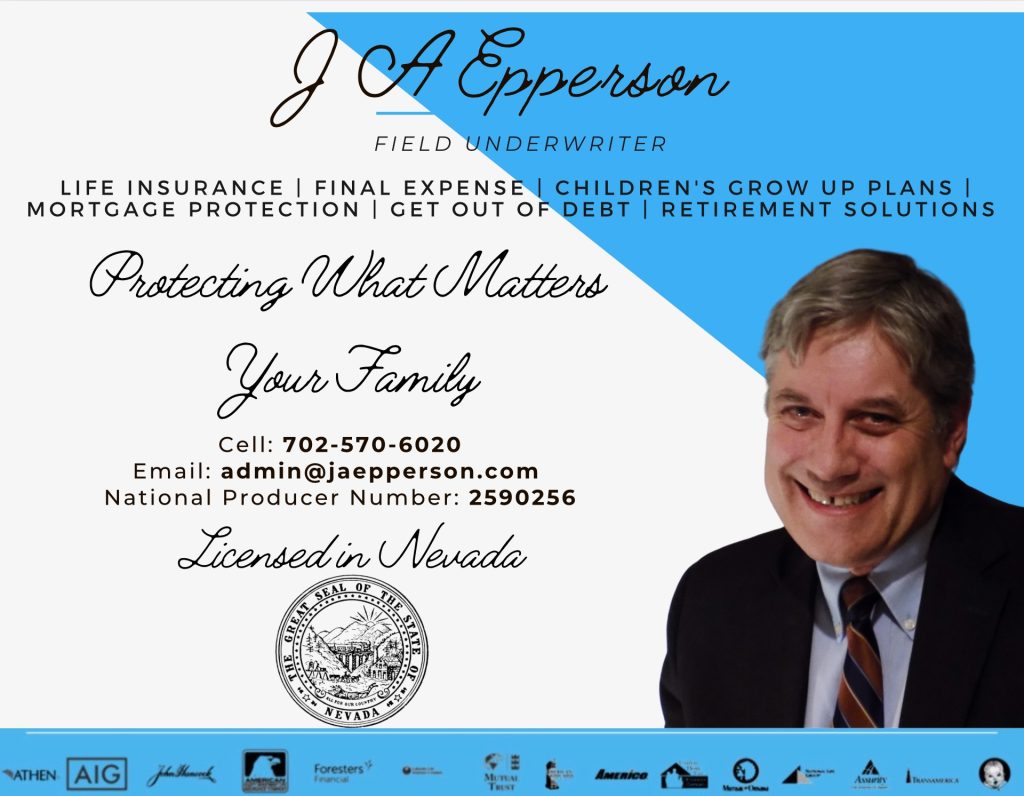

by J A Epperson, MBA | Call or Text 702-570-6020 | email: j@jaepperson.com Schedule a Call:https//jaepperson.com/schedule

When a spouse or key provider dies, the first year is the hardest.

Emotions are raw.

Routines break down.

And financial pressure shows up fast.

Most advisors agree on one thing:

The first 12 months after a loss is not the time for major financial decisions.

But the bills don’t pause.

That’s where thoughtful life insurance planning matters.

The critical period is the first 12 – 18 months following the death of a breadwinner or key provider. Experts agree: this is not the time for major decisions like selling a home, shutting down a business, or relocating the family.

This is the time for families to have time to grive

Time to stabilize

Time to make clear-headed decisions… Not panic-driven ones.

The goal isn’t wealth transfer or long-term investing. The goal is stability.

That’s why I offer two types of Coverage that work together

Final Expense Coverage – This is designed to handle:

- Funeral and burial costs

- Medical bills

- Immediate household expenses

It removes pressure from loved ones during the first few weeks.

Short-Term Income Protection or Critical Period Insurance—a simple and affordable way to keep your household or small business running while your loved ones process the loss and plan their next steps.

Unlike traditional life insurance that’s meant to replace decades of income or leave a legacy, Critical Period coverage is laser-focused on helping families get through the first or second year.

It helps pay:

• The rent or mortgage

• Utilities and groceries

• Childcare or school expenses

• Small business continuity costs like payroll or vendor contracts

This type of policy can mean the difference between a grieving spouse making level-headed decisions—or being forced into a rushed home sale, a bad financial deal, or shutting down a viable business just to survive.

For many of my clients, Critical Period Insurance is the missing piece in their protection strategy. You may already have a burial or final expense plan. Maybe you’ve purchased a term policy for income replacement. But what’s in place to cover urgent needs during the first 12 months—when families are most vulnerable?

As a licensed life and health insurance advisor with over two decades of experience in risk and compliance, I specialize in helping clients keep their homes, stabilize their finances, and buy time to think clearly.

A Critical Period policy is:

• Affordable – Plans often cost less than traditional life coverage

• Fast – Many issue without a medical exam

• Focused – Designed to cover only what’s needed, when it’s needed most

Whether you’re a working mom, a single dad, or a small business owner, let’s make sure your loved ones aren’t forced into chaos during one of life’s hardest seasons.

Currently licensed in Nevada, Colorado, Arizona and Oregon

Don’t delay, today may be your last day!

Let’s protect the people who depend on you—especially when they’ll need it most.

Sorry, no recent posts. Come back again for information that could benefit you and your family.

Call or text me at 702-570-6020

Or email me if you have questions. j@jaepperson.com

You can also schedule a Zoom call with me schedule a time with me by clicking here